With all the noise that exists about investing, it is difficult to have any confidence in what the correct solutions are for your investments. While there are almost limitless options regarding the different types of investments (some obviously better than others), this week we are focusing on Class A Share Mutual Funds. A-Share Mutual Funds have lost a considerable amount of popularity over the last several decades. A-Shares, per the Investment Company Institute, now represent 16% of mutual fund assets under management, down from 56% in the year 2000. This decrease in popularity has come on the back of increased information to the consumer as well as lower cost investment vehicles for the consumer.

How does an A-Share Mutual Fund Work?

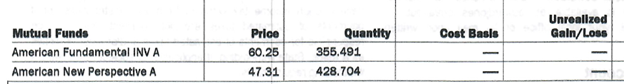

Fortunately, A-Shares come with a fun hack to help keep them straight. A-Shares come with a front-end load, just as A is at the beginning of the alphabet. The big charge on these guys is right at the beginning. If the only charge was at the beginning then it might make these a little easier to stomach as an investor. Unfortunately, that is not the case. In addition to the front-end load these mutual funds also have ongoing expenses as well. Let’s take a look at the following from a sample statement:

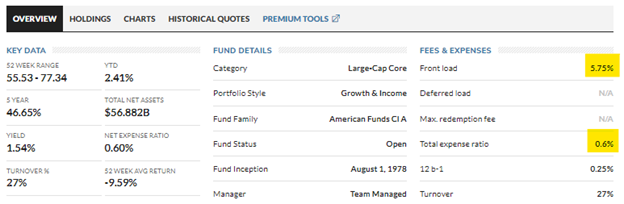

The key giveaway on the above screenshot is the A at the end of it. To find the underlying costs for the investment, go to a search engine and type in “Name of the investment + marketwatch”, so in the case of the first mutual fund listed, “American Fundamental INV A Marketwatch”. Look for Marketwatch as the main underlying website and follow the link. Once in the link, you will get a chart followed by some key data.

The key data we are looking for is highlighted in yellow. The front load represents the up-front commission paid, and the total expense ratio represents the ongoing cost of the investment. In this case, on a $100,000 investment, $5,750 would be charged up front along with ongoing fees of $600/year.

The Case for A-Shares

Proponents of A-Share Mutual Funds say that you pay less into the mutual fund long-term by getting the commission done up-front. Generally speaking, the alternative to the commission paid in A-Shares is a fee for Assets Under Management (AUM). While these fees can range dramatically, most come in at a rate around 1%. (You can read more about finding your current fees in an AUM model here.) So back to our $100k example now, this means a fee of $1,000 annually for the mutual fund in an AUM fee model. Obviously the fund changes value over time, so this is a bit of an over-simplification, but you get the idea. Using the hard numbers from above along with the assumption of a 1% advisory fee, the A-Share mutual fund becomes less expensive after year 12.

As with all financial products, they can have their place. In the case of the A-Shares, if you believe that this individual mutual fund will be the right solution for you for 13+ years, then it would be the right solution for you.

What Were You Doing 10 Years Ago?

Obviously the above title is stated a little tongue-in-cheek, but it is worth thinking back to 10 years ago and wondering if your life circumstances and thus your investment objectives were different. While the obvious goal for any investment is to make money, so many things can happen that require a different approach. Not only can your life change in a decade, but investment products and markets can change dramatically as well. A decade ago, Exchange Traded Fund’s (ETFs) were a lesser known, more niche product. Today they are mainstream and commonplace in many of the portfolios that I build due to the low-cost nature of the funds. If you want to change your investments for any reason, whether personal or for a better investing opportunity in the first decade of owning an A-share mutual fund, then you were almost certainly better off with one of the many other investment options that exist.

The Elephant in the Room

One of the biggest issues with the front-end loads on mutual funds is the elephant-sized conflict of interest that it generates. The truth is that financial planners who sell these A-shares only get paid when they are initially sold. This can either lead to poor customer service once it is sold, or that planner constantly being on the lookout for the next opportunity to generate another commission. To me, this conflict of interest generates too wide of a gap between what is best for the client and how the financial planner is paid, leading to either poor customer service or poor advice.

The Best Financial Plans Contain a Healthy Amount of Flexibility

As it states in our core values: the best financial plans contain a healthy amount of flexibility. Ultimately, none of us know what the future holds. While a good chunk (how’s that for specificity 😊) of your assets should be invested for the long-term, this does not mean that those long-term assets should be held hostage by the up-front commissions paid from your A-Share Mutual Fund. As always, if you have questions about your current investment portfolio and would like a complimentary consultation, click here to schedule a call.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.