A Harris poll in 2017 found that 60% of respondents had no idea how much in fees and costs was associated with the financial advice they were getting. This is for good reason as the financial industry has intentionally made it difficult to understand how much you are paying. I have found in talking with my clients that most people are woefully uninformed when it comes to understanding the costs associated with investing. It is my hope that reading this will provide you with a framework for you to determine how much you are paying for financial advice. Below, I have shown snippets from real statements to provide you with very practical tools to evaluate the costs associated with your financial plan.

*All snippets provided are taken from actual account statements, with the approval from the account owner. Any identifying information has been removed.

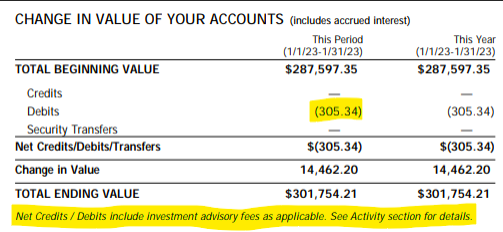

Our first example is on the summary page of your statement. This is generally page 1 or 2 of your statement.

As you can see on the statement above, I have highlighted the debits section as well as the disclaimer on the bottom that lets you know, in fact, that these debits include your investment advisory fees. In this case, because nothing was added or taken out of the accounts, the entirety of the debits are investment advisory fees. The $305.34 is the monthly advisory fee for this particular statement. As you can tell, the period for this statement is the month of January. If we take the fees of $305.34 and divide that by the original beginning value of $287,597.35, we get 0.00106 as a decimal, or 0.106%. This is the fee, as a percentage, that you are paying every month to the advisor. If we then multiply that number out by 12 months, we get .0127 as a decimal, or 1.27%. The number does not come out as a nice round number because this company charges on a per day basis. Since account values move daily, when you do the math, it is unlikely that you will come up with a nice round number. In this case, we can reasonably assume that the fee being charged is 1.25%. That’s what you pay to the advisor/company for their services.

Re-stated, take the fees charged for the period (one month in this case) and divide by the beginning account balance. Multiply that by the number of periods in a year and then convert it to a percent. It should almost always equal between 0.5% and 2%.

Of course, the easier, less “mathy” way would be to find your original contract with your financial advisor, or simply just ask your financial advisor as all of this information is required to be disclosed.

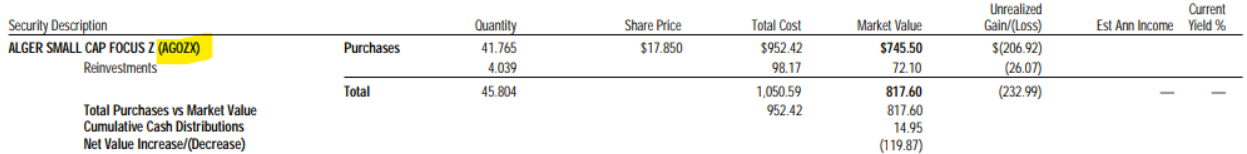

In my experience, this is the piece that the 60% of respondents know and understand. They pay x% to their advisor on an annualized basis for managing their investments. Unfortunately, the costs associated with investing don’t stop there. Often times there are significant costs associated with the mutual funds that are not disclosed on the statement. These are expressed as the mutual fund’s expense ratio. Fortunately there is a way to discover the costs of these without any math. You can easily discover the expense ratio on your mutual funds by typing in the ticker symbol and “marketwatch” on google. This security description is taken from the same statement as above, I have highlighted the ticker symbol, which is AGOZX.

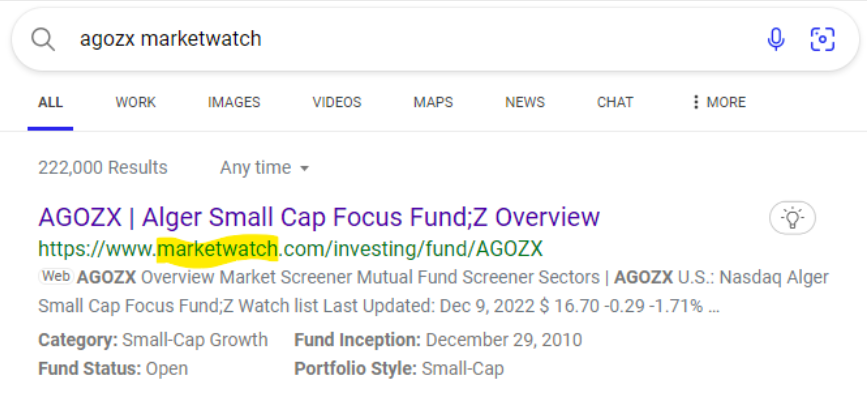

Grab the ticker symbol off your statement, type that into your search bar followed by “marketwatch”. Generally it will be the very first search result, look for marketwatch as the main website.

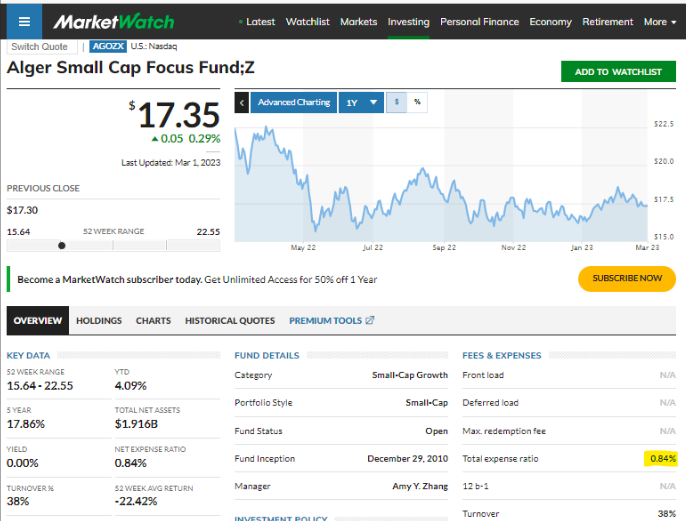

It will pull up a screen like the following which will include a chart with historical performance. What you are looking for is the total expense ratio which I have highlighted towards the bottom right corner.

In this case, the expense ratio is 0.84% for this particular mutual fund. This is charged in addition to the 1.25% for the advisory fee, so this client is spending 2.09% for this particular investment. Now each different holding has a different expense ratio, so we would need to evaluate all of the holdings in the portfolio to know the aggregate expense ratio. Just to help connect the dots, this would mean that the client would spend $2,090 in a $100,000 investment into the above mutual fund with the above advisor. In my experience, very few people understand the expense ratio in their investments, and therefore do not understand the fees and costs associated with their investments.

While some advisors believe these more expensive mutual funds are worth the cost, the research just doesn’t bear that out. Check out my blog on Why your Investments Should be Boring if you are interested in learning more about that.

A quick note: This finds your cost of investing if you are being charged a fee for Assets Under Management (AUM). While this is the most common way to be charged for investment advice, there are other ways you may be charged. We will cover the different ways in later blog posts, like this one.

I know that this can be overwhelming for many people, so if you would like some help determining the costs associated with your investment portfolio schedule a call.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.