As many of you reading this blog probably know, I have six children who range in age from nine to nine months. Obviously, our kids are still young, so the jury is still out on whether we have raised financially responsible children, however we have had some recent wins in the teaching money values department. This is my attempt to share these wins and help to impart “wisdom” and inspire others on their journey of teaching good money handling and values on to the next generation.

Before I get into the specifics of our recent victories, I want to talk about a basic formula that we use when we try to be intentional with teaching our kids about money values:

Skin In The Game

Maybe this seems obvious to most people, but for the lesson to actually make a difference with the kids, they need to have ownership either of some of the money, or the situation surrounding the money.

Specific Purpose

I’m not quite sure the title effectively represents what I am trying to say, but ultimately the money needs to be a means to an end, not an end unto itself. In other words, teaching them to save for some unnamed thing in the future, or to save “so you have money” won’t tie into the child’s emotions enough to make a lasting impression.

Connection to Work

While this is related, it is not exactly the same as the first bullet point. Money at its core is simply an exchange for our labor. Helping kids understand hard work and it’s connection to money is imperative.

Stewardship Mentality

I may lose some people on this last point, but ultimately it’s important for us to teach the kids to have a mentality that sees money as a means to serve others, particularly once basic needs are met, instead of seeing it simply as a means of serving ourselves. In our house, we shoot for the first 10% of money earned is spent giving back in some way.

Now on to the specific examples of some recent wins that we have had:

Our school-aged children all participate in the Accelerated Reader (AR) program at school. The school has an AR store at the end of each semester that allows the students to exchange their points for prizes. Many of these prizes are simple trinkets, you know the kind of things a 7-year old thinks is cool but ends up lost or broken within a few days. However, they also have a program that allows the students to exchange their AR points for gift cards. Ultimately all of our kids ended up choosing a combination of gift cards and trinkets. I am grateful that the school allowed gift cards to be utilized as this has given us the opportunity to teach some nice money lessons with money that they “earned” over the course of the school year by doing their “job” of being a student.

Right away this gave our kids a connection to work as well as giving them skin in the game as this was their money they earned. The first thing that we required was for them to donate items back to the AR store that were worth approximately 10% of what they earned (i.e. if buying a soccer ball was worth 20 points, and you had 400 points you should donate two soccer balls to the AR store). They were able to shop for and ultimately choose the prizes to donate back. This ended up being a great opportunity to teach charitable giving as not only were they giving from what they earned, but they were also very familiar with what they were giving to. It is probably worth noting here that our kids attend a Catholic school that we support through tithing to our parish, so programs like this are 100% supported by donations.

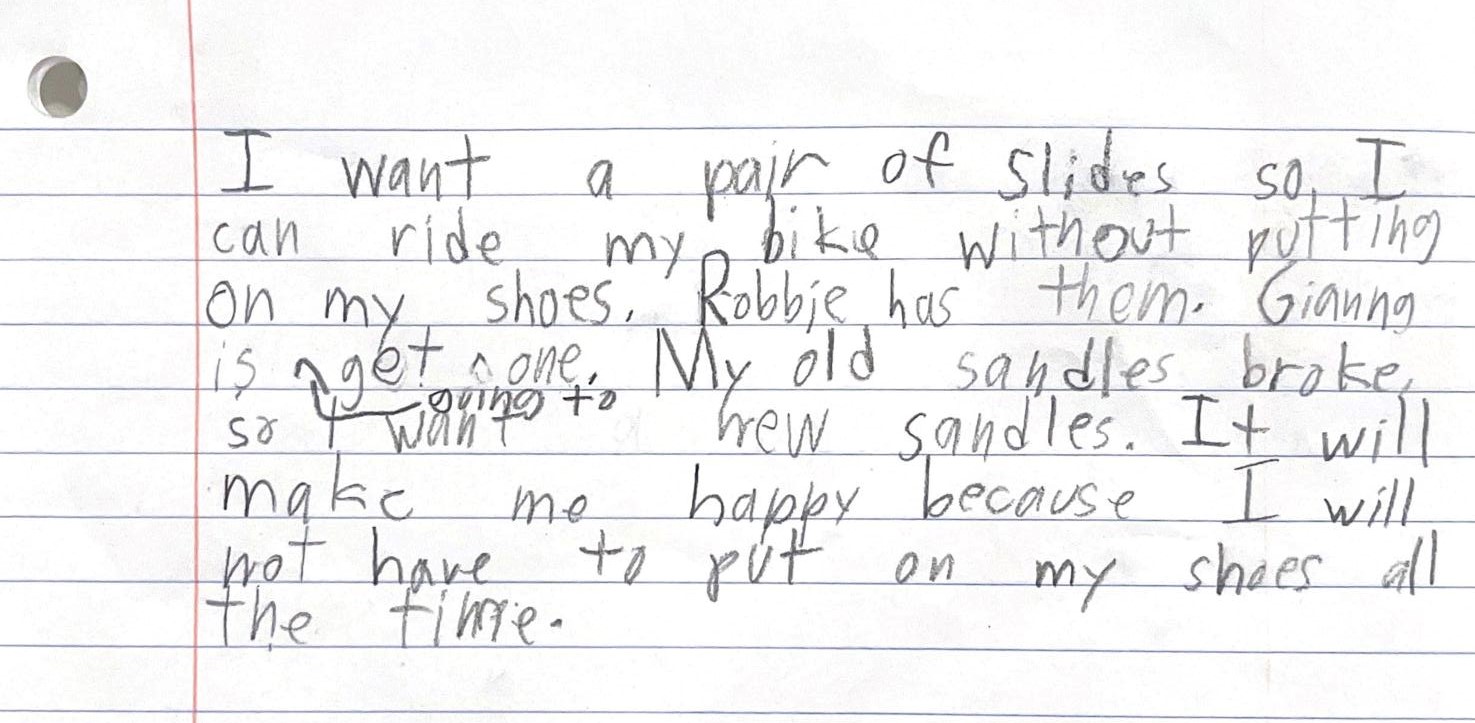

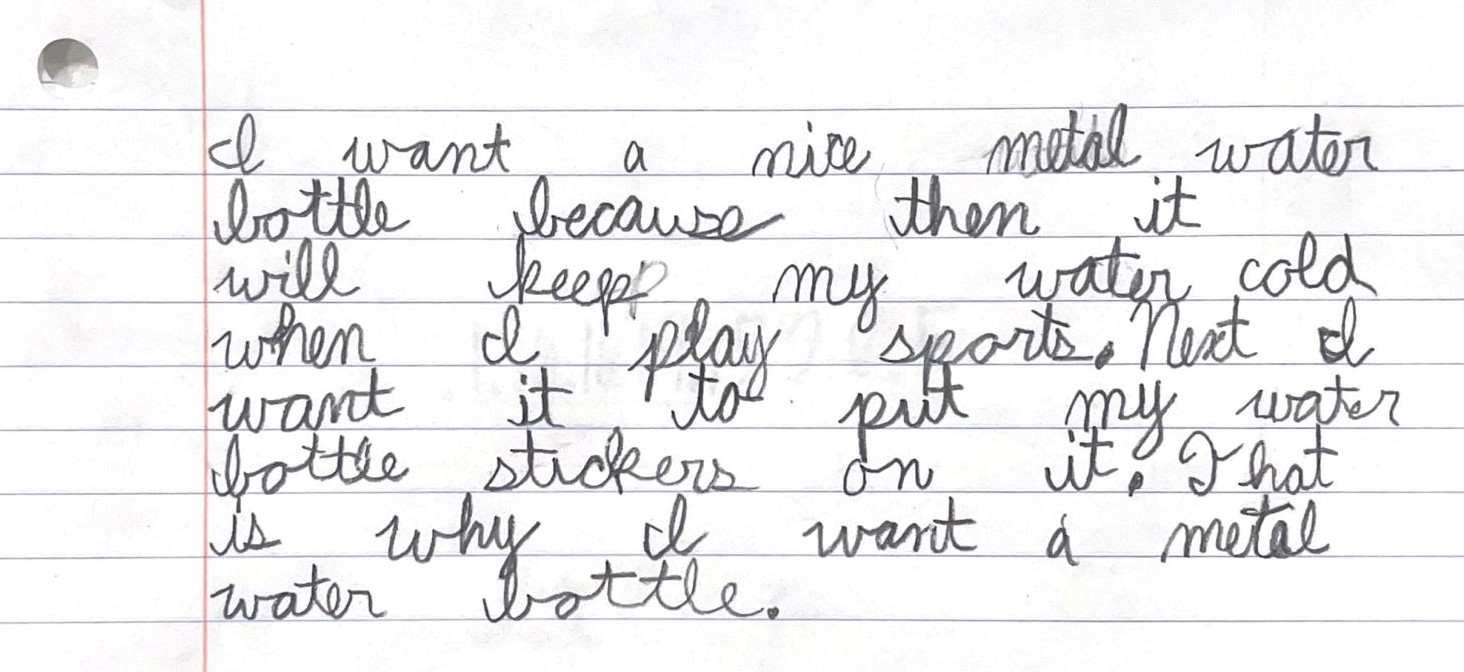

Now that the items to donate have been purchased, we are allowing the kids to spend their gift cards, with some parameters put into place. They are required to write a paragraph about each item that they would like to purchase and give us their reasons as to why they think it will help make them happier. This has made the kids be very thoughtful and frugal regarding their purchases. For example, our 9 year old daughter decided to purchase sandals. She chose to go with a different color of sandals than what she initially wanted because the different color was less expensive. It also had a side benefit of getting our children excited about writing in paragraph form (why not integrate financial education with a little language arts 😊). Additionally, because the kids have been thoughtful regarding what they would like to purchase, it has led to them taking better care of their items. All in all, it has been very little additional work for us to implement. The extent of the work on our end has been allowing them to peruse Amazon to look for the items that they would like to purchase and reading the paragraphs that they submit to us and having discussions with them regarding what they want to purchase.

Another thing that we are doing is having the kids “earn” money to help pay for the summer camps that they want to attend. I’m sure that you’ve noticed, but there is no shortage of opportunities to get your kids involved in different programs over the summer: baseball, softball, volleyball, basketball, football, pie making, jewelry, book club, drama club, math club, and the list goes on. While it is impossible to make them all, we are believers in getting our kids involved and want to give them the opportunity to develop the skillsets being developed or introduced in many of the camps. Since many of these camps are $50 or more, it does not take long to add up to a fairly large number when you attend multiple camps with multiple kids.

In order to help give our kids more “skin in the game” and a higher level of appreciation for the opportunities being afforded to them, we require them to earn enough money to pay for one of the camps that they would like to attend. While they don’t yet have official jobs, they are able to earn small amounts by doing odd jobs around the house. For example, last year every sticker plant found and pulled in the yard was worth a quarter. We have also had them earn money by folding laundry, cleaning the garage, or other simple home tasks that don’t fall into their normal chore rotation. We just have a single sheet of paper that acts as their ledger for the summer, so implementation for this has also been relatively easy.

What We Don’t Do

One thing that we don’t do is pay our kids an allowance. I do know some families that have had success teaching their kids about money by giving them an allowance, but I have never been a believer. While we don’t do an allowance, our kids each have a nightly chore that we put on a weekly rotation. Our kids contribute more than their share of the mess to the house and as such, they are expected to contribute (at an age appropriate level) to the regular cleaning of the house. This is an expectation of being a member of the household, and as such does not come with any pay or rewards. Ultimately, while it would check the box for connecting income to work, I still want the kids to know that there is work connected with keeping a house that does not come with pay. As an aside, I also really strive to be consistent with expectations for the kids, and I know myself well enough to know that I would struggle with consistent implementation of an allowance.

This blog isn’t meant to be a discourse on passing down money values to kids, but rather a few simple plug and play examples that are easy to implement. While I certainly don’t claim expertise on parenting strategies that best pass down money values, I have spent quite a bit of time considering how to best pass down the financial skills and values that have served Liz and I up to this point in our life. It is my hope that this blog can serve as a launching pad by giving ideas and a framework to help others be intentional about passing down their money values.

If you would like to reach out to tell me about ideas you have about passing down your money values, or want to pick my brain about some other things we have done to form our kids around money, reach out directly to me at tyler@QEDwealthsolutions.com.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.