The second most important Q acronym (behind QED of course 😊) that all retirees should be familiar with is QCD. QCD stands for Qualified Charitable Distribution. It is a provision in the tax code that allows for distribution from your tax deferred retirement account to go directly to a qualified charity. This may be the single biggest missed opportunity for tax savings as there are so many people that simply don’t know about it.

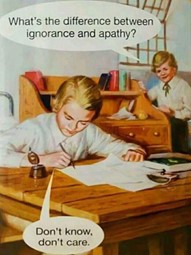

Ignorance or Apathy?

It really does beg the question…why is this opportunity missed so frequently? In the age old question of ignorance vs. apathy, I’m going to have to vote for both in this instance. Let’s first take the stance of ignorance. Many DIYers are just simply not aware of this provision of the tax code. Those who are aware of it may simply just not know how to execute the QCD in such a way that guarantees the funds get to their desired location.

While the DIYer rarely falls into the apathetic category, it is a category that many financial advisors fit into all too well. Let’s explore why; QCDs, as their name implies, are distributions. This means that it will inherently reduce the assets under management (AUM) that the advisor manages, thus reducing their income. It also takes a little more quarterbacking than a more traditional distribution. To summarize this in an easy-to-understand math problem:

(Increased Work) + (Reduced Fees) = APATHY

What Makes QCDs so Great?

Let’s take a look at the mechanics of a QCD and why it is such a big (and relatively easy) way to reduce your tax bill. As stated earlier, a QCD allows those who are age 70.5 or older to distribute money directly from their tax-deferred retirement accounts to a qualified charity. This effectively allows you to never realize that income, thus allowing you to donate to that charity while never paying taxes on those dollars. Remember, you never paid taxes on this money when it was earned either as you elected for the tax break of an IRA, 401k, or some other tax deferred account that was available to you.

I Just Write off My Charitable Contributions on My Taxes…

Do you really, though? In my experience many people believe that they reduce their taxes by donating charitably, but in practice few are eligible. This is because charitable deductions only reduce your tax liability if you itemize instead of taking the standard deduction. Statistics tell us that 90% of individuals take the standard deduction.

While comparing and contrasting itemizing versus standard deduction could certainly be a blog unto itself, we can succinctly summarize it here by saying that your itemized deductions must exceed $12,950 for individuals or $25,900 for married filing joint before you would consider itemizing. While itemized deductions include many things in addition to charitable contributions, including your home mortgage interest, your state and local taxes, as well as unreimbursed medical expenses, most people simply do not have itemized deductions in excess of the standard deduction. The result is many people not receiving a tax benefit for their charitable deductions.

Should I make a Qualified Charitable Distribution?

Here at QED Wealth Solutions, we are big proponent of intentionality with your money. Therefore, we DO NOT believe that you should make charitable contributions simply for the tax benefits. We see this as the tax tail wagging the proverbial dog. Many of the people we work with are already in the habit of giving, and many of our clients plan to INCREASE their charitable giving in the future (we really do get to work with some incredible people!). For those clients, we see it as our duty to ensure that they aren’t leaving their dear old Uncle Sam a tip.

It is our belief that this strategy is vastly underutilized. Here at QED Wealth Solutions, we would be happy to meet with you to help determine is right for you.

Schedule a call to learn more.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.