Unless you have lived under a rock over the last few years, you have noticed inflation increasing slowly and not so subtly reaching into your pocket. For many Americans, this has taken a toll on their financial safety net and impacted their ability to sustain unexpected expenses. We all now know that the so-called transitory inflation, as labeled by the Fed back in April of 2021 was severely misguided as we are left to stretch our dollars a little farther to stay ahead.

Once the Fed finally recognized inflation was sticking around in March of 2022 (a full 5 months after they dropped the transitory label), they began to raise interest rates in an attempt to dump some water on an over-heated economy. This had it’s intended effect and annualized inflation, as measured by the Consumer Price Index, peaked in June 2022 at a 40-year high of 9.1%. Since the peak it has seemed to be relatively smooth sailing since; we saw decreases each of the next 12 months following the relative peak in June of 2022.

Has Inflation Increased Lately?

While increasing interest rates have done a nice job dropping the annualized CPI rate to 3.0% in June of 2023. You may notice that it is no longer June, so what has it done lately? Well unfortunately, we have seen a somewhat steady increase of inflation since June, raising the annualized inflation rate back up to 3.7%.

How CPI is Figured

While the Consumer Price Index (CPI) may not sound that cool, it's actually the magic number that tells us whether we're getting more or less bang for our buck in the ever-changing world of consumer goods and services. To cook up this number, a team of economists at Bureau of Labor Statistics, creates a magical “basket of goods”.

Imagine a massive cart filled with groceries, rent, gas, clothes, and the occasional doctor's visit. Now, these economists keep tabs on how much this basket of goodies costs every month, visiting stores, checking online, and doing some serious number-crunching. The price of this basket is then tracked from month to month. The result is the CPI, a number that lets us know how much prices have moved given as an annualized rate of change. So, when you hear that CPI is up 3.7%, this means that something that cost $100 last year now costs $103.70. These numbers help inform economists, policymakers, and the public on the impact of inflation.

While CPI is always expressed as an annualized number, it is important to note that in practice it is the sum of the previous 12 months of monthly change.

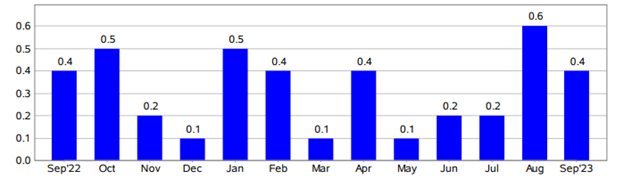

"One-month percent change in CPI for All Urban Consumers (CPI-U), seasonally adjusted, Sep. 2022 - Sep. 2023 Percent change" - Bureau of Labor Statistics

In other words, to find the current CPI, you simply add up all of the above numbers from October of 2022 through September of 2023. If you check the math, this is where the 3.7% number that is currently reflective of our annualized CPI.

To those of us who have spent our entire adult lives in the new millennium, this recent spike in inflation feels particularly painful. When you look at the long-term data however, it has been a bit of a rollercoaster ranging from nearly 10% in the 1910’s, deflation in the 1930’s, and back up again in the 70’s and 80’s. With that being said, the long-term inflation rate (From 1913 to 2020) is 3.10%. Another way of looking at this is that prices go up on average by about .26% each month. If you look at the last 13 months shown above, you will notice that we are not too far off historical averages for inflation. Some fall above and some fall below the historical monthly average but our current annualized rate of 3.7% is close to our historical average of 3.1%.

Why Inflation Will Almost Certainly Increase

When you consider that CPI is simply the sum of the previous 12 monthly installments of inflation it becomes a little easier to spot trends. One simple illustration of this is the most recent month’s (September 2023) CPI. Both September of 2022 and September of 2023had an increase of 0.4%. So to find the new inflation rate, we subtract the subtract September ’22 number of 0.4% from current CPI of 3.7% and subsequently add the new September ’23 number of 0.4% and arrive at the same number of 3.7%, so our CPI remained unchanged from August ’23 to September ’23.

3.7% - 0.4% + 0.4% = 3.7%

The reason that I am so certain that inflation will increase by year end isn’t because I necessarily think that inflation is once again out of control (though I don’t think the trend of the last two months is necessarily positive). It is simply due to the fact that we had historically low months in November and December of 2022. Assuming that we have another “equal” month from October ’22 to October ’23 and we simply have the historical average of .26% (which CPI rounds to the nearest tenth, so .3%), then we will see inflation rise to 4.0% when the December numbers are released in early January.

How Increasing Inflation Impacts Markets

Generally speaking, I ascribe to the Efficient Market Hypothesis (EMH), which stated simply is the belief that share prices reflect all existing available information, making the current market price the fair market value of securities.

In other words, I believe that the market has already taken into account the expectation of higher CPI numbers to close out the year. This however, does not entirely account for the reactionary individual investors or the talking heads that will be screaming at you to expect a recession coming soon due to these “new and surprising” inflation metrics.

While our crystal ball remains ever-cloudy, it is my general expectation that markets will be up and down to close the year and the market will end the year approximately where it sits today (10/12/2023). It still seems to be a fool’s errand to try and time the market and the only way we see to win in the long-term is to stay invested for the long-term. We don’t know when the stock market will begin to make its trek back up, but we are certain that whoever acts as if they do know has some snake oil to sell you.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.